Butterfly effect theory

Edward N. Lorenz (American meteorologist: 1917-2008)

Invented “to highlight the possibility that small causes may have momentous effects.”

Predictability: Does the Flap of a Butterfly’s Wings in Brazil Set a Tornado in Texas? Presented at: American Association for the Advancement of Science, December 29, 1972 [Link]

Black swan theory of unexpected surprises

Nassim Nicholas Taleb (2010)

[extraordinarily unexpected events: we did not see them coming]

[“Oops, didn’t see that one coming!“]

The title is a metaphor to describe “an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist – a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild.”

The Black Swan: The Impact of the Highly Improbable [Link]

Gray rhino theory of giant known misses

Michele Wucker

[highly probable events: we ought to have known what will happen]

[“How did that happen?”]

Gray Rhinos is Wucker’s variation of Black Swans, defined as “a highly probable, high-impact threat: something we ought to see coming. Wucker believes that the problem is systemic: the political and financial world rewards short-term thinking, and it’s difficult for institutions to pivot quickly when necessary.

With so many recent examples of failures to respond to obvious threats, we ought to have a better handle on why we miss them, but cognitive biases make this difficult. Wucker explores the denial that keeps us from seeing threats, the panic that occurs when we don’t make decisions in time, and ways to implement solutions and take reparative action “after the trampling.”

The Gray Rhino: How to Recognize and Act on the Obvious Dangers We Ignore [Link]

Grey Swans theory of potential although unlikely horrendousities

Daniel Liberto for Investopedia.

[An event of high significance whose possible occurrence is predictable although the “probability is considered small.”]

[It is possible that a Planet-Killer might hit us someday…”]

Grey Swans is another variation of Black Swans. Greys are predictable. Black Swans are unpredictable.

What is thought to be possible, but improbable, whose appearance might spark globally significant change? Examples include: Brexit, the impact of the internet to news’ facts validation , and a political outsider winning a country’s Presidency. Grey Swans is similar to an event “in electrical engineering, (where) gray swan refers to the kind of events that rarely happens but have great impact on power systems.”

Grey Swan: What it is, How it Works, Examples [Link]

Planet Killers theory of avoidable impossibles

David Huer, 2014-forwards.

[highly probable but seemingly impossible events, with momentous consequences, that we can plan for]

[That Planet-Killer is coming in 2032...”]

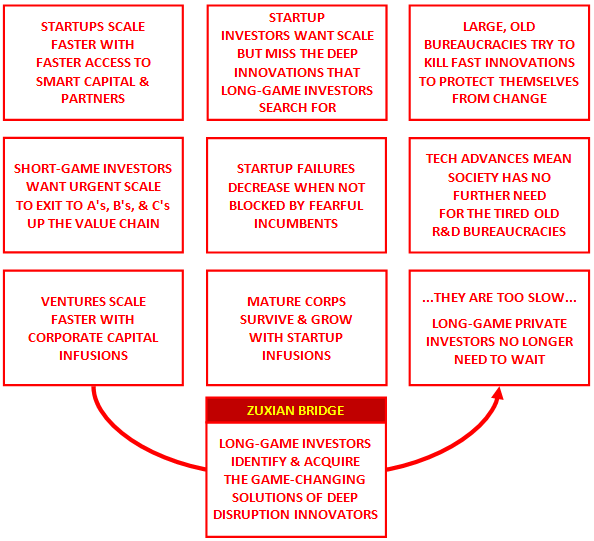

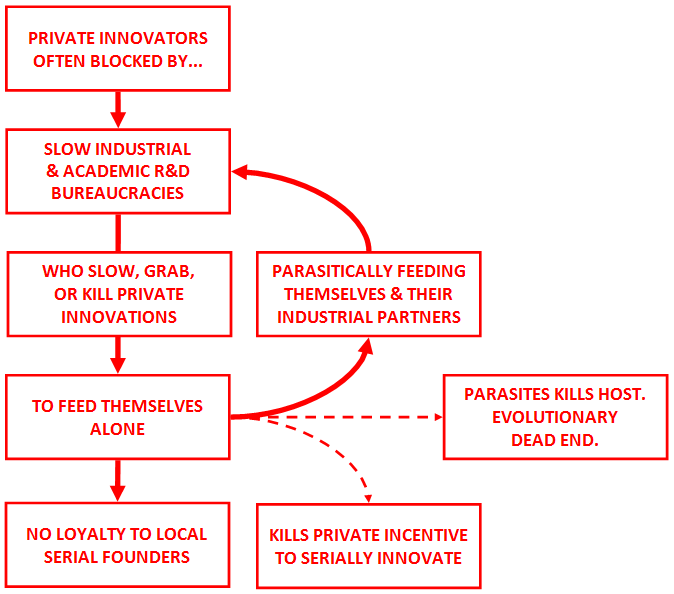

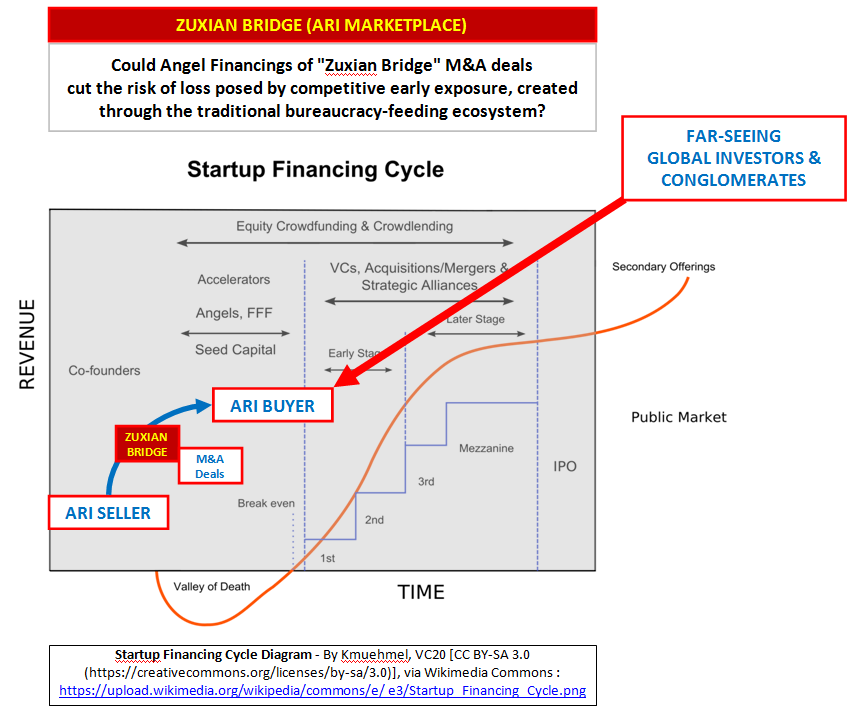

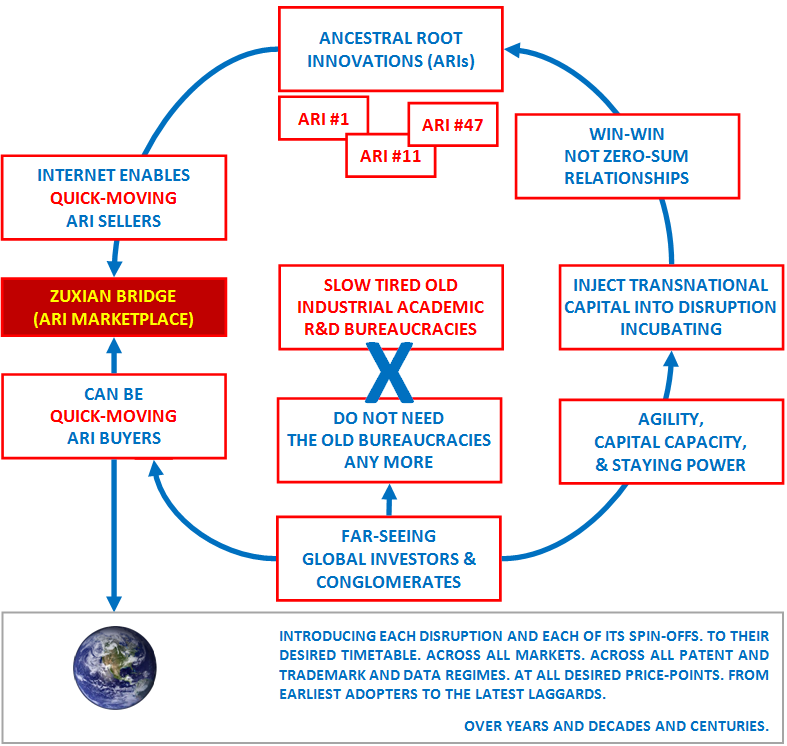

David Huer has been seeding the Planet Killers/”Own the Asteroid” concept since 2014. It is possible, indeed probable, that Black Swans and Gray Rhinos can be avoided – and Grey Swans planned for – and Butterfly Effects nurtured – by acquiring access to private earliest-stage disruption sources. Before competitors have the glimmering that momentous change is coming.

Own the Asteriod© when Planet Killers strike.

Don’t be the Dinosaur.

Asteroid Artwork by David A. Hardy: http://www.astroart.org/

Grey Swan image by : Arcaion